Understanding the Uniform Act of 17 October 2023, Execution Authorities and Information Access in OHADA Law

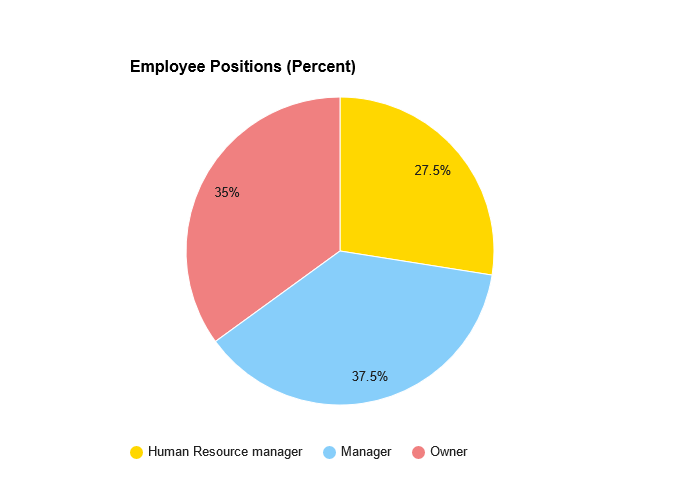

Roles and Responsibilities in Simplified Recovery and Enforcement

The Uniform Act of 17 October 2023, recently adopted by the Organization for the Harmonization of Business Law in Africa (OHADA), introduces new measures aimed at enhancing the efficiency of debt recovery and enforcement processes across its member states. This article focuses on the authorities designated to execute these procedures and the safeguards put in place to ensure fairness and legality.

Who Can Execute Enforcement Measures?

Article 1-2: Authorized Authorities for Enforcement and Sale

Under this act, only designated authorities in each OHADA member state have the power to execute enforcement actions or conduct sales related to debt recovery. These authorities, which include Bailiffs or Process-servers, operate under strict guidelines defined by national laws to ensure ethical and lawful enforcement.

These officials must adhere to professional standards, ensuring that all enforcement actions are justified and lawful. They are obligated to refuse any enforcement request that is "manifestly unlawful," and failure to do so can lead to civil liability. This provision is crucial for protecting the rights of both creditors and debtors by preventing any abuse of power.

How Can Creditors Access Debtor Information?

Article 1-3: Accessing Necessary Information

The act introduces a streamlined process for creditors to obtain vital information about a debtor’s assets. A judge or court president can authorize a Bailiff or Process-server, who holds a writ of execution, to request specific details from state entities, public institutions, and credit bureaus. This provision is designed to bypass professional secrecy where necessary, but only in cases where it directly supports the enforcement process.

The information accessible under this rule is strictly limited to what is necessary for debt recovery—namely, details about the debtor's assets, address, and employer. No other personal or sensitive information can be disclosed. If the entity asked to provide this information believes the request is unwarranted, they have the right to appeal to the judge, whose decision on the matter is final.

Protecting the Use of Debtor Information

Article 1-4: Limitations on Information Use

To safeguard privacy and prevent misuse, the act places strict conditions on how collected information can be used. It specifies that such data should only be used for the enforcement of the specific debt for which it was requested. Sharing this information with third parties is prohibited unless explicitly required by law, and the creation of personalized information files based on this data is not allowed. These rules are designed to ensure that enforcement actions do not infringe on individuals' privacy rights.

Impact on Businesses and Individuals

For businesses and individuals operating in OHADA member states, these provisions clarify the roles of enforcement authorities and set clear boundaries for their actions. This transparency helps build trust in the legal process, ensuring that enforcement is conducted fairly and within the bounds of the law. For creditors, it streamlines debt recovery, providing a clear path to accessing necessary information while protecting debtors' rights.

By clearly defining the responsibilities and limitations of enforcement authorities, the Uniform Act promotes a balanced approach to legal enforcement. This approach is essential for fostering a stable business environment and ensuring that both creditors and debtors are treated fairly.

Stay updated on the latest OHADA legal changes. Download the OHADA accounting app from Solafide.tech or sign up for cloud services at Accounting.Solafide.tech.